The IRS tells us that “it is critical that business owners correctly determine whether the individuals providing services are employees or independent contractors.

The IRS tells us that “it is critical that business owners correctly determine whether the individuals providing services are employees or independent contractors.

Generally, you must withhold income taxes, withhold and pay Social Security and Medicare taxes, and pay unemployment tax on wages paid to an employee. You do not generally have to withhold or pay any taxes on payments to independent contractors.”

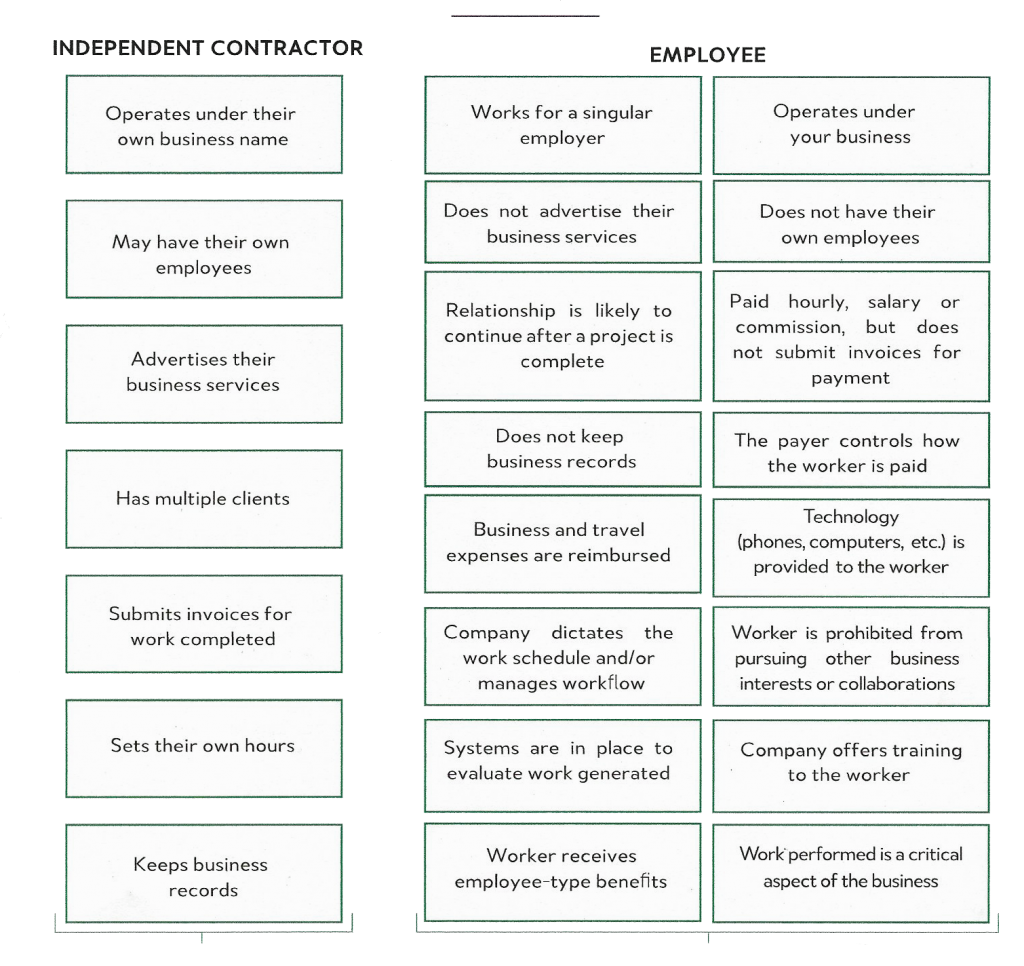

So what determines whether we are hiring an employee or an independent contractor?

The table below outlines some of the differences that should help you make that distinction.